What’s up with our pensions?

In recent weeks, pension plan reform has returned to the headlines with a vengeance. Instead of dreaming about “freedom 55”, we’re beginning to wonder if we might have to work until we’re 67 before getting our pensions. But why? What, exactly, is the problem?

In recent weeks, pension plan reform has returned to the headlines with a vengeance. Instead of dreaming about “freedom 55”, we’re beginning to wonder if we might have to work until we’re 67 before getting our pensions. But why? What, exactly, is the problem?

“Will there be enough left for us?” That’s the question any number of Canadian citizens are starting to ask while watching the evening news. Frankly, the signs are troubling: private pension funds with years-long unfunded liabilities, employers going out of business and leaving behind a half-empty pension fund, public pension plans in disarray… Not to mention anaemic levels of personal savings: according to a recent Harris Decima study, barely 32% of Canadians have made RRSP contributions for 2011. Even more striking, while people are allowed to contribute up to 18% of their income to an RRSP, it looks alarmingly like their contributions for 2011 will only be around 2%.

Which raises a simple question: where will the money come from to allow the next generation of pensioners to live without working for 25, 30, 35 years?

A comprehensive system continually being questioned

Keep in mind that the Canadian pension system has been called into question for decades – in fact, ever since it was created. The oldest among us will remember the 1970s and ‘80s, in particular, when inflation was so high that the question wasn’t “Will there be enough money left?” but “Will all that money be worth anything?”.

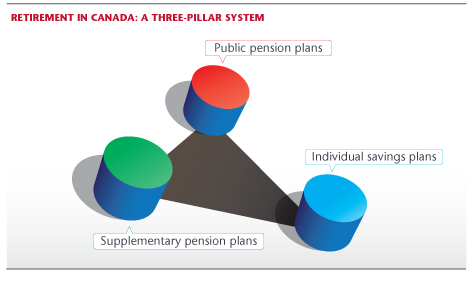

This time, the feeling of imminent crisis stems from the fact that all the components of the system suddenly seem more fragile than we thought. The following illustration gives an overview of the system.

How is it that all three system components could threaten to collapse at the same time? Because of two developments:

- Demographic evolution

- we know you’ve heard this before, but life expectancy in Canada rose from 71 years to 83 years between 1950 and 2008: that’s an extra 12 years to live on the income accumulated during a working life that hasn’t become proportionally longer;

- another trend: with baby-boomers now approaching retirement, the ratio of the number of public pension plan beneficiaries to the number of workers is expected to rise significantly in the next couple of decades. Fewer workers for more pensioners: one more stress on the CPP and the QPP, which are financed from employment income.

- The new financial market environment

For several years now, the performance outlook for financial markets has been much lower than in the 1990s; a number of stock markets have posted anaemic returns in the past 10 years, and the fixed-income market is suffering from either historically low interest rates (on this side of the Atlantic), or an unprecedented level of risk (in several European economies). The result: slower growth of retirement capital.

Now add historically low levels of retirement savings and there can be only one conclusion: something has to be done about pensions.

We’re not the only ones

That’s why we can expect the pension debate to remain front-page news for the next few years. In fact, this debate is far from being exclusive to Canada: an OECD report published in 2011 analyzes the pension challenges facing almost all the developed countries. This report sketches out the same three solutions that seem to be taking shape in Canada at the moment:

- lengthen the active working life;

- implement new plans to encourage voluntary savings;

- refocus certain programs on the segments of the population who are most in need.

But another social trend might also help to ease the pressure: with people today in better physical and mental shape than their predecessors at the same age, they may be less interested in the old dream of freedom at age 55, or even 60… After all, why retire when you can still be active and highly capable?

How about you? When do you think you’ll really get off the treadmill? It’s a good topic to discuss with your financial services professional!

![]()

In collaboration with Desjardins Financial Security Independent Network.

Confidentiality Policy | Contact editorial team

© All rights reserved. Desjardins Financial Security Independent Network 2025.

Desjardins Financial Security Independent Network is a registered trademark owned by Desjardins Financial Security. Mutual Funds representatives act on behalf of Desjardins Financial Security Investments Inc.

Mutual Funds are offered through Desjardins Financial Security Investments Inc.