The recession is over

But exercising caution would be wise.

Good news! The governor of the Bank of Canada recently announced that economic growth is back, with projections 2.0% and 3.3% for the second and third quarters, respectively. The news is similar in the U.S., where the economy has been showing positive results for the past three months. Japan, China, Germany and France are also seeing an economic turnaround.

Something to rejoice about

Even better … According to the National Bureau of Economic Research, since 1945, American recessions have lasted an average of 10 months and expansion phases … 57 months. The fact that our neighbour to the south is also out of the recession bodes well for a return to sustainable prosperity.

But…

Where do we stand?

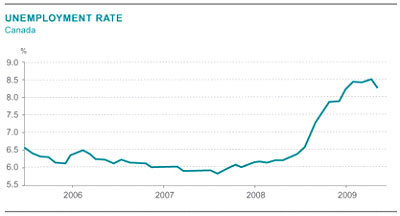

Fact remains that this recession has left our economy in a strange position. The information in the graphs below provides some insight. Unemployment remains at levels not seen in years, while corporate profits are still not all back on track. Obviously, we can’t expect a real recovery without companies prospering and consumers having jobs that give them the means to start spending again.

Source: Statistics Canada

Source: Statistics Canada

This is why many experts predict that the road ahead will be bumpy, with ups and downs as part of an overall upward trend. At the present time, the turnaround is owed mainly to government stimulus programs, which might only have a temporary effect.

On the stock market

The stock markets have lived up to their reputation, that is, historically, anticipating an economic by two to three quarters. Since March, the S&P/TSX composite index has gone from approximately 7,500 points to over 11,500 points, a gain of nearly 50%.

Source: Yahoo Finance

But even major investors seem to think this situation is too good to be true. In October, many of them simply pulled out, considering the market recovery too strong given the uneasiness about economic recovery. Talk points to a possible correction, in other words, a setback in stocks of approximately 15%.

How should we adapt?

The economy is recovering, but not as strongly as had been hoped. Right now, signals are mixed. What should we do under the circumstances? Having a serious talk with your financial services professional is the only way you can make a wise decision.

Here are some helpful rules to remember:

- Don’t be too opportunistic

Had we known last March that stocks would take off the way they did, we would all have bet our homes on the market. Fact is, even if we understand the overall logics of the market, we never know when it will spring into action. In the same way, it would be reckless to gamble on a short-term correction followed by a recovery. - But being a little opportunistic is fine

All bear markets have long-term opportunities. Despite their upswing, the markets are still at least 25% lower than they were at their peak. The idea is not necessarily to gamble on low-priced securities, but to identify those economic sectors that will benefit most from the recovery. Then, in these sectors, choose the type of business that is likely to provide the best return. Historically, businesses with small or mid-size market capitalization are the ones that have provided the best return right after recession. But this was not always the case. It’s very possible that, since investor confidence has been deeply shaken, investors will focus on sound, large-cap companies.

- Take your investment horizon into account

Before making a decision, make sure you take your investment horizon into account. If you need our money in three years, market volatility should steer you towards a more conservative strategy than if you need it in 10 years.

As you can see, there is no one good way of adapting to the recovery. Only you can decide what you should do. Take the time to think about it and have a serious talk with your financial services professional.

![]()

In collaboration with Desjardins Financial Security Independent Network.

Confidentiality Policy | Contact editorial team

© All rights reserved. Desjardins Financial Security Independent Network 2025.

Desjardins Financial Security Independent Network is a registered trademark owned by Desjardins Financial Security. Mutual Funds representatives act on behalf of Desjardins Financial Security Investments Inc.

Mutual Funds are offered through Desjardins Financial Security Investments Inc.